This case is New South Wales Crime Commission v Dib [2025] NSWSC 1587, decided in the Supreme Court of New South Wales by Justice Lonergan on 19 December 2025.

It is a civil proceeds of crime action brought by the New South Wales Crime Commission (NSWCC) against Mohamed Dib under the Criminal Assets Recovery Act 1990 (NSW).

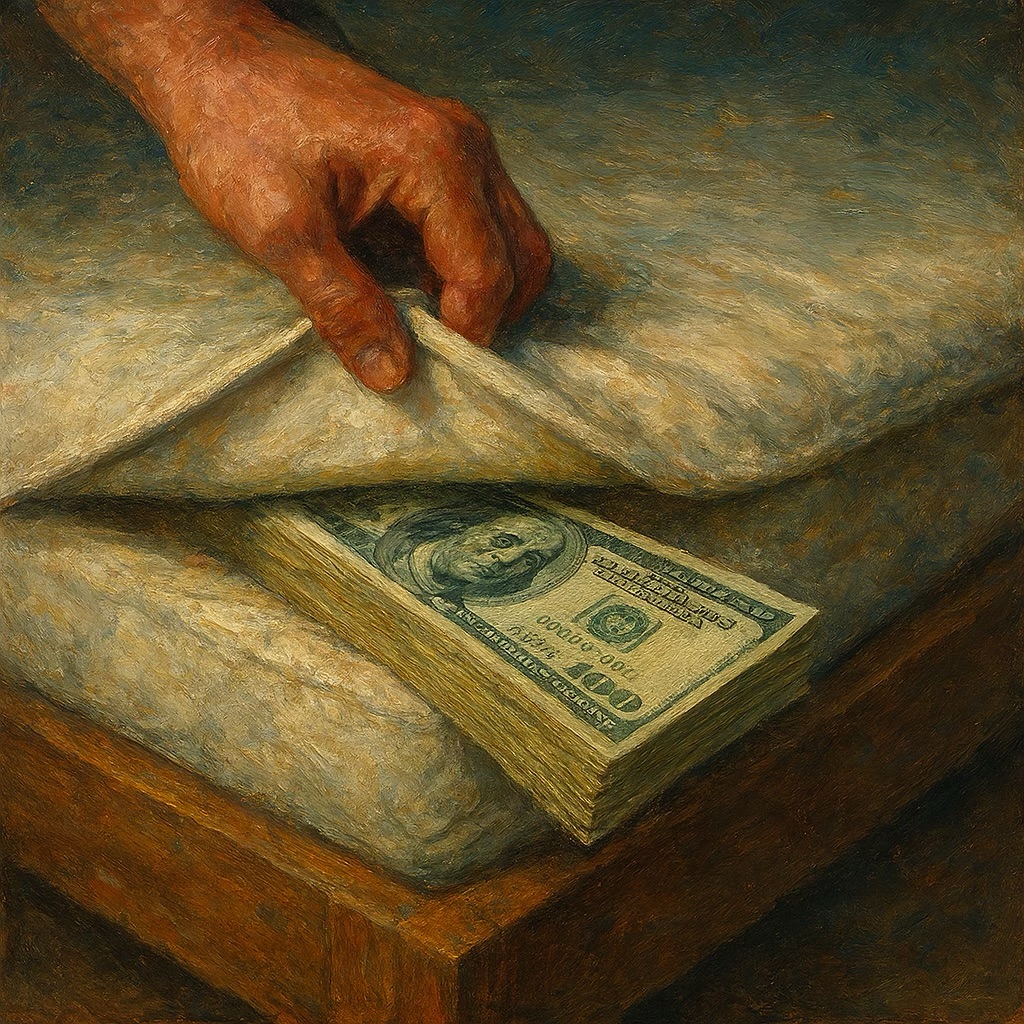

The Commission sought (and obtained) a proceeds assessment order requiring Dib to pay $311,275.02 to the State. This amount represents the value of proceeds the court found he derived from serious crime-related activity.

Background and Key Facts

- Dib was convicted in 2017 of supplying a commercial quantity of cocaine (262 grams) under the Drug Misuse and Trafficking Act 1985 (NSW). He received a sentence of 7 years and 3 months imprisonment (non-parole period 4 years and 2 months).

- The NSWCC applied for the proceeds order based on an analysis of Dib’s financial position and expenditure during the 6-year period before the application date (roughly 13 November 2009 to 13 November 2015).

- A forensic accountant engaged by the Commission calculated that Dib had unexplained expenditure of $311,275.02 after allowing for legitimate known income and expenses. The Commission also attributed an estimated $117,000 in value from the cocaine supply itself.

Main Legal Issue

Under s 27 and s 28 of the Act, once the preconditions are met (including the defendant’s conviction for a serious offence), the court assesses the value of proceeds derived from illegal activities. The onus shifts to the defendant to prove, on the balance of probabilities, that specific expenditure or assets came from sources unrelated to criminal activity.

Dib claimed his spending was funded legitimately through:

- Family contributions (from his mother, sister, and others),

- Loans from relatives/friends,

- Taxi driving income/tips,

- A community “Jamyah” savings scheme, and

- Other informal arrangements (including alleged international transfers).

Court’s Findings

The judge found Dib’s evidence — and that of his supporting witnesses (family members) — to be incredible, inconsistent, implausible and uncorroborated. Key problems included:

- Changing and contradictory explanations for cash sources and deposits.

- No documentary proof (e.g., no bank records, loan agreements, transfer receipts, or independent evidence of the “Jamyah” scheme).

- Evasive and uncooperative testimony from witnesses.

- Discrepancies between affidavits and oral evidence.

- Failure to call potentially corroborative witnesses (leading to adverse inferences under Jones v Dunkel principles).

The court therefore held that Dib failed to discharge the onus under s 28(3). The unexplained expenditure was treated as proceeds of his illegal drug activities. There is no general discretion to reduce the assessed amount once the figure is established.

Outcome

- Proceeds assessment order made for $311,275.02 payable to the State.

- Dib ordered to pay the NSWCC’s costs.

This is a typical proceeds-of-crime recovery case where the authorities use civil proceedings (lower standard of proof) to claw back alleged criminal gains, even after the criminal sentence has been served.

See full case here: